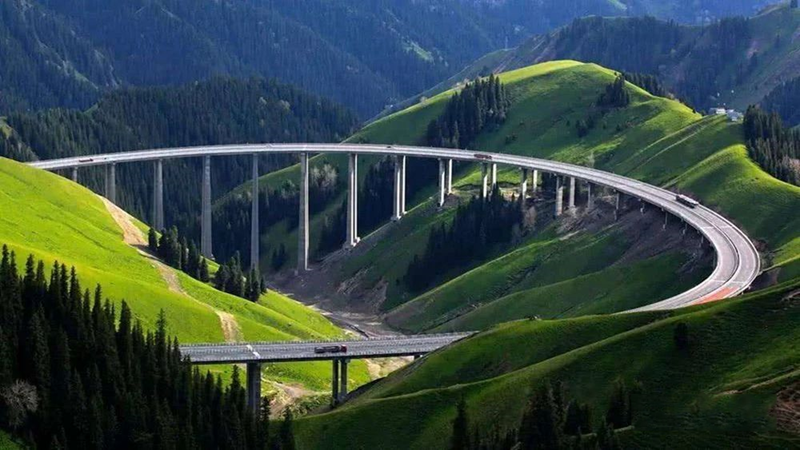

It is reported that the issuance of new local special bonds nationwide has broken trillions, all of which are used for infrastructure construction. At the same time, the news that the Ministry of Finance intends to issue another 1 trillion yuan of special debt in advance has caused heated discussions in the industry. Some institutions predict that the scale of the issuance of special bonds in 2020 may exceed 4 trillion yuan. If the proportion of provincial special bonds as capital is increased to 25%, up to nearly 6 trillion yuan in infrastructure investment can be mobilized throughout the year, stimulating "new Infrastructure investment is 0.45 trillion yuan. This allows the total scale of infrastructure investment that can be spurred by today's special debt to reach the level of 10 trillion yuan-the market for aggregate demand this year will continue to improve!

At the same time, in an environment where the current global epidemic situation has not yet clearly ushered in an inflection point, the pressure of imported domestic control risks persists, the industrial chain has recovered differently, and the pressure of economic growth has been highlighted, the continued efforts of China's fiscal policy have attracted much market attention. As an important starting point for active finance, special debt is gradually becoming one of the important focus points for stabilizing economic growth.

So, what are the characteristics of special debt?

1. Quick

The issuance time is advanced, the issuance progress is accelerated, and the funding progress is accelerated-compared with last year, the issuance of special bonds this year is 19 days earlier than in 2019. As of March 20, Beijing, Tianjin, Liaoning, Ningbo, Fujian, Jiangxi, Guangdong, Sichuan, and Yunnan had all completed their issuance tasks. Up to now, the progress of central infrastructure investment to local transfer payment funds by 2020 has been increased by 12.6 percentage points over the same period last year.

Special debt issuance or further speeding up-In the case that the amount of local government bonds issued in advance is not much, Wang Kebing, a first-level inspector of the Budget Department of the Ministry of Finance, said in a recent press conference of the Ministry of Finance, "According to the Standing Committee of the State Council The meeting decided that after fulfilling the legal procedures, it is planned to issue another 1 trillion yuan special debt line in advance in the near future ". At the same time, at present, "we are instructing all localities to map the specific bond quota to specific projects as soon as possible, organize the preparation of bond issuance, and strive to complete the issuance by the end of May to ensure early issuance, early use, and early results, and form a boost to the economy as soon as possible."

2. All used for infrastructure construction

As of March 20, the new special bonds issued by various places were 1023.3 billion yuan, all of which were used for the construction of transportation facilities such as railways and rail transit, as well as major infrastructure projects in the fields of ecological environmental protection, agriculture, forestry and water conservancy, municipalities, and industrial parks. At the same time, the scale of bonds used for capital for qualified major projects in various regions has reached 120 billion yuan. This 120 billion yuan can drive considerable social capital and expand effective investment.

From the perspective of capital investment, the special debt from January to mid-March 2020 has complied with the State Council ’s regulations. The capital investment is mainly concentrated in transportation infrastructure, ecological and environmental protection, municipal construction, and people ’s livelihood services, but there are still 1 % Of the specific debt is invested in the land storage and shed reform projects in the industrial park.

Generally speaking, as in previous years, land storage, shed reform, and infrastructure construction are the three major investments in special debt, accounting for about 30%. In September 2019, while the State Council executive meeting issued some of the new special debts in 2020 in advance, it also clearly stated that "special debt funds should not be used in land reserves and real estate-related fields." This means that the 1 trillion yuan issued in advance The new special debt will be mainly used for infrastructure-related projects. In some local provinces that have announced the use of funds raised from special bonds in January-February 2020, infrastructure-related construction has been significantly increased to about 80%. It is mainly invested in traditional infrastructure areas such as railways, highways, and rail transportation, as well as new infrastructure areas such as 5G, artificial intelligence, industrial Internet, and smart cities.

"It needs to be pointed out that since this year, the investment in special debt has shown a trend of continuous optimization-designed to meet the needs of epidemic prevention and control and the needs of the 'new infrastructure' investment field." Yuan Haixia, deputy director of the China Integrity International Research Institute, pointed out After the management proposed that the special bonds issued in advance this year should not be used in land storage, real estate and other related fields, the pre-issued land storage and shed reform special bonds were not issued this year. According to a rough estimate, special debts (including inter-city high-speed railways, inter-city rail transit, industrial parks and other types of special debts) in the field of 'new infrastructure' account for 12%. Yuan Haixia believes, “With the continuous efforts of the steady growth policy, the special debt in the infrastructure sector, especially in the“ new infrastructure ”sector, may be further accelerated. It aims to continue to expand infrastructure investment and maximize shortcomings to create sustained economic growth. Important foundation. "

Considering that special debt projects have allowed market-based financing, and the State Council has reduced the capital rate of infrastructure projects to 20% (according to relevant news, on the premise of using provinces as the unit, the size of special debt funds for project capital in 2020 The proportion of the scale of the province ’s special debt increased to 25%.), Which makes the total scale of infrastructure investment that special debt can pry today reach 10 trillion.

This not only marks another change in the positioning of special debt funds, but also officially opens a new round of capital construction cycle.

At the time of the global economic crisis, the infrastructure we will usher in will be unprecedented.

Sand and gravel is the most basic and indispensable building material in engineering construction.

The sand and gravel industry must achieve a healthy, orderly and high-quality development goal in a new round of infrastructure construction!

Article excerpt from "China Sand and Stone Net"

-

Focus Project | With a total investment of 487 million yuan, The customer of Sanming Heavy Industry in Liuzhou, Guangxi will soon build an annual output of 4 million tons of fine sand aggregate production line

Focus Project | With a total investment of 487 million yuan, The customer of Sanming Heavy Industry in Liuzhou, Guangxi will soon build an annual output of 4 million tons of fine sand aggregate production line -

The 2022 Spring Festival holiday notice of Longjian Group

The 2022 Spring Festival holiday notice of Longjian Group -

Longjian Group held a virtual equity incentive promotion meeting in the fourth quarter of 2021

Longjian Group held a virtual equity incentive promotion meeting in the fourth quarter of 2021 -

Hand in hand to build heart to heart | Longjian Group Party branch went to Dashu Village to carry out "Urban and rural branches hand in hand" pair to build donation activities

Hand in hand to build heart to heart | Longjian Group Party branch went to Dashu Village to carry out "Urban and rural branches hand in hand" pair to build donation activities -

.png) Chongqing "Meter" high-speed Railway Network Construction | Full Construction in five years, Full operation in ten years -- Chengdu-Chongqing Middle Line high-speed railway Construction "Acceleration"

Chongqing "Meter" high-speed Railway Network Construction | Full Construction in five years, Full operation in ten years -- Chengdu-Chongqing Middle Line high-speed railway Construction "Acceleration" -

How to create green mines and green factories?

-

In the process of installation and acceptance of equipment of sand and gravel aggregate production line with production capacity of 600 tons at the beginning of construction in Hubei Province

In the process of installation and acceptance of equipment of sand and gravel aggregate production line with production capacity of 600 tons at the beginning of construction in Hubei Province -

Warmly congratulated: Mr. Long Fujian, chairman of the group company, was elected vice president of Chongqing sand and stone association

Warmly congratulated: Mr. Long Fujian, chairman of the group company, was elected vice president of Chongqing sand and stone association